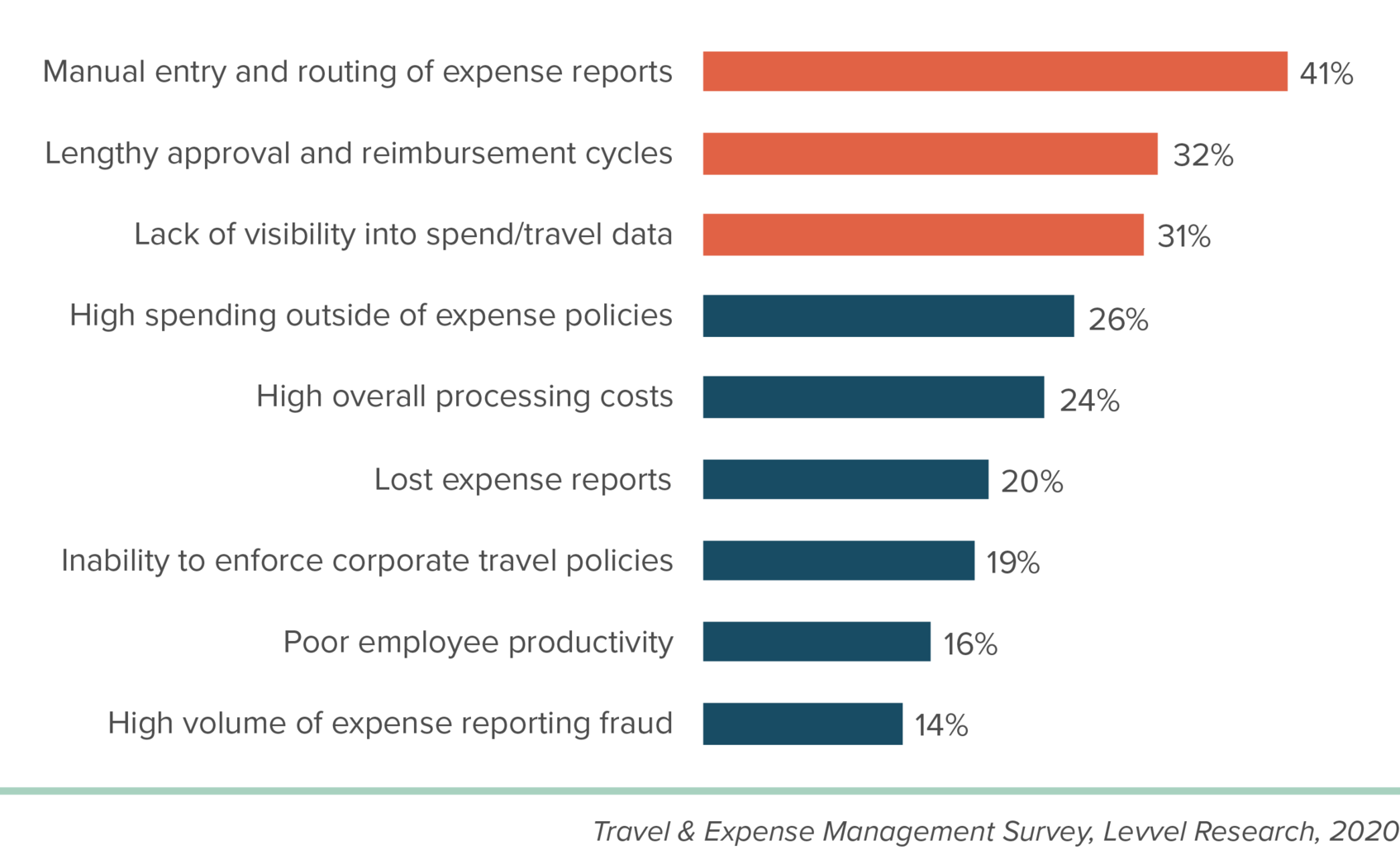

There had been substantial improvements in Enterprise Resource Planning over the last few years. Businesses are increasingly showing interest to try their hands on tools and platforms that are infused with current & next-gen technologies such as Automation, IoT, and Artificial Intelligence. But managing organization’s second-highest indirect expense, Travel (behind labor) is still mostly manual. Travel planning, receipt submissions, reimbursement claims, assessment of policy adherence – most of it happens manually in the back office. Levvel Research has conducted a survey recently for over 300 professionals who is directly involved with their organizational payment processes or Travel and Expense Management policies. Here are the major setbacks they found in their current methods of operations.

'Travel' may have taken a back seat for now due to the on-going Pandemic but there are many other ways businesses, and their representatives continue to incur inevitable expenses. The slowdown is not an end to business travel and expense. Digitizing the process of organizational expense management and monitoring it provides a whole new set of data > Insight > Business Intelligence. Travel and Expense management is not only to gain control over expenditure but to acquire added value in the form of Data. Yet, most of the growing organizations feel a TEM platform is complicated and ineffective. That is because, even when there is a third-party tool involved, the finance team may struggle with security, performance, speed, accuracy, visibility, and guidelines related issues. Before you steep into denial that you are doing fine, ask yourself these questions.

- How easy and convenient is the receipt submission process for your employee?

- How soon your employee turns in the reimbursement paperwork after the cost incurrence?

- How early does your employee plan the travel?

- How long does it take for your finance department to assess and approve the expenses?

- How soon does your employee get their reimbursement after the paperwork?

- How often does your employee realize that a certain expense is not covered under company policy after submitting for reimbursement?

- Apart from ‘what is the spend?’, how much do you really know about your employee’s expense pattern?

Now that we are done with that quick intervention, we say, Travel and Expense Management Automation can solve most of your problems. Allow us to show you how to encourage your employees to travel and spend smarter with a new-age TEM partner such as SAP Concur’s web and mobile based application.

SAP Concur is an integrated travel, expense, and invoice management application that is specially designed to simplify the lives of all the parties that are involved in the process of business travel and expense management.

Submitting Claims

This is generally the most tedious part of the reimbursement claims for the employee and the long paper or excel-based processes doesn’t really encourage them to get to it sooner. There are just multifold of challenges in the traditional procedure of Travel and Expense Management. Just by employing Optical Character Recognition (OCR), tasks like itemization and receipt imaging can be digitized saving every one’s time. Creating Receipt evidence in a centralized location adds more transparency to the process.

What was happening? | What can change? |

|---|---|

Not knowing/remembering what is reimbursable | Infusing travel policy into the application and giving the employees an opportunity to justify the additional expense. |

Losing/not collecting bills or vouchers | Having an option to take a picture of the bill and upload it immediately into the application. |

Failing to meet the deadlines of submission | Integrating corporate cards and vouchers into the application. Encouraging employees to make the most of mobile application for their end-to-end Travel and Expense management. |

Loss of productivity and efficiency | Going almost-to-complete digital in the process. Demonstrating how the task can be done in fewer keystrokes. Saving the employee and finance team’s time. |

All the receipts being scattered across devices and formats | Having unlimited cloud storage that keeps receipts accessible anywhere, using any device and at any time. |

A US-based research firm Aberdeen quoted that processing an average expense report costs up to $35.02. That includes the front-line finance team, resources, stationary, etc. Although this case study was released in 2015 the number could be a little out-of-date considering the current circumstances and digital advancements, it is still a shocking figure.

Manager Approvals

The longer the manager takes to review and approve a claim, the longer an employee will be waiting for their money to be reimbursed and that is a direct hit on employee satisfaction. But with paper/spread sheet-based system, approval process isn’t a walk in the park. Checking the dates, policy adherence, validity and legitimacy of the receipts will take its own sweet time. So, here’s how we can change that.

What was happening? | What can change? |

|---|---|

The manager not being at the same place where the ‘Tray’ of vouchers and receipts are. | Accessing the submissions on the mobile application. Verifications and approvals on the go. |

Need to verify company travel policy for each bill in question. | Infusing travel policy into the application and aiding the finance team to cross check the terms while working on the job. |

Long email chains and spending days for clearing queries. | In-app feature to raise query and get instant response. Hence faster approval process |

An extra perk: with clear and transparent trail of documentation, always be audit ready. |

Processing Data

Some of the personnel live out of a suitcase because of the nature of their job. Some rarely have to travel. Irrespective of their travel frequency, both kinds have their own unique reasons to not to love the manual process of expense reports. These are literally the kind of problems ‘Automation’ loves to answer.

What was happening? | What can change? |

|---|---|

Employees deliberately stacking claims so they can submit multiple claims in one go. | Offering a convenient, easy-to-use, remotely accessible mobile application to cut down the piling. |

Mayhem created by the hybrid model of paper and excel sheets. | Simplifying the situation to just uploading pictures, typing in details and almost nothing else. |

Long email chains and spending days for clearing queries. | In-app feature to raise query and get instant response. Automating the approval process. |

According to Global Business Travel Association (GBTA), 1 in 5 expense reports (19% of claims) are filed incorrectly. Some of them could be intentional, some because the employees file them in a hurry to not miss the deadline, and some are mere human errors. Automation not only swifts up the process but cuts down the error rate to 0%.

Audit and Compliance

It might sound like the traditional method is ‘doing just the job’ until it’s time for an Audit. If you are a company who handles Travel and Expense Management using good old paper, can you always be compliant and confident about your papers?

What was happening? | What can change? |

|---|---|

Reconciliation, reimbursement, and payroll integration hold-ups | Enabling automated pre-requisites and direct reimbursement deposits for receipts that are all-clear. |

Financial teams having to work extra hours before Audits. | Being always audit ready with clear and transparent trail of documentation. |

Cumbersome process of manually checking for duplications and non-compliant claims. | Employing Optical Character Recognition (OCR) and leaving no scope for errors. |

Preserve all the receipts and vouchers for audits. | With unlimited cloud storage, pulling up all the documents & streamlining them is a task of few clicks. |

Gathering Insight and Reporting

Alright now the employee incurred an expense, you’ve verified it, audited it, and reimbursed it. Is that all? No. Here is what you need to know about acquiring internal ‘Business Intelligence’. The goal is to turn data into information and information into insight.

What was happening? | What can change? |

|---|---|

Process ending after audit and reimbursement | Financial settlement ends there but gathering business data starts. |

Deriving actionable insights that’ll help planning expense budget more effectively. | |

Creating saving opportunities such as negotiating better prices with commonly used suppliers. | |

Identify non-compliant individuals and departments and take corrective actions. |

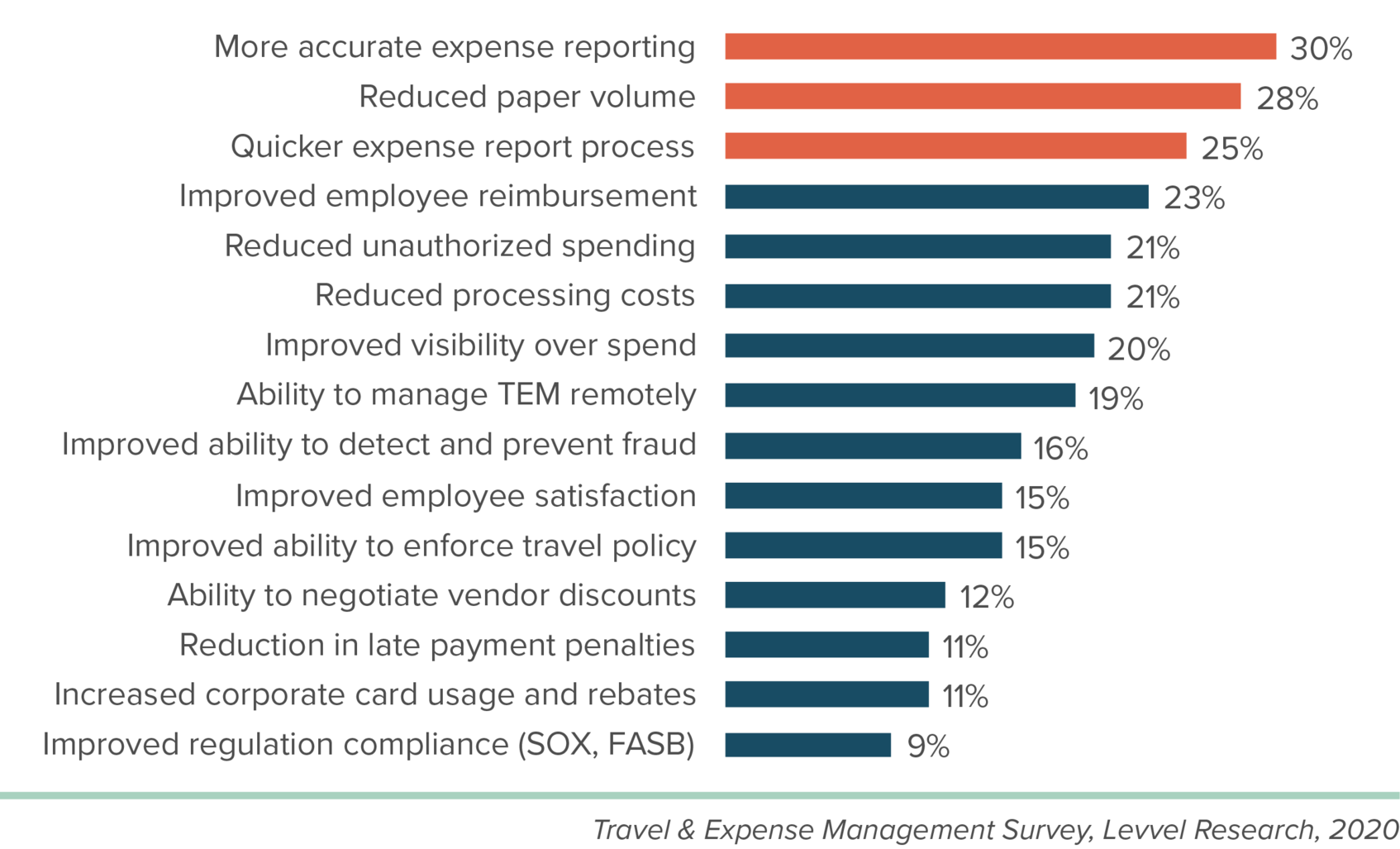

Benefits of having automated Travel and Expense Management

In addition to improved accuracy, increased speed, and reduced processing costs; employing a TEM tool is proven to enhance employee productivity. The Travel and Expense Management survey by Levvel Research that we mentioned at the beginning of this article also asked their respondents to vote the top benefits of TEM tool for their organization and here are the results.

Building a 3600-expense-map with automated Travel and Expense Management

Implementing an automated TEM system starts with objectively reviewing the entire process, integrating the suitable platform, and ensuring the transformed process runs smoothly from receipt to reimbursement to report generation. When it is all done, the expectation is – employees, managers and finance team spending less time and efforts on submissions, approvals, and processing, respectively.

Getting real-time spend management insights gives the CFOs a unique perspective of their travel programs from all dimensions. Being able to see the patterns improves the chances of optimizing the expenses. The traditional way of assessments tends to focus on direct spend (travel, accommodation, food, etc.) driven through the travel agency. But recent studies have shown that this spend represents on average only 59% of total program T&E reimbursed on an expense report and reported on the general ledger (G/L). A 3600-expense-map sounds like a good idea now, doesn’t it?

Why SAP Concur?

Decrease in processing costs

Decrease in manpower and effort

Increase in policy compliance

Increase in visibility and transparency

Insight into spending trends

Real-time insight into policy violations

Audit ready with a digital audit trail

Faster, verified reimbursements

Assessing the current state of your expense management process and implementing an end-to-end automated solution isn’t a one-person job and we will be glad to get you started. It is okay to have a ton of questions before signing up for a process-altering org-wide change and our team of experts appreciate a good question-answer session. Drop us an email today! info@qentelli.com