In the dynamic arena of finance, a digital revolution is underway, led by the formidable force of Robotic Process Automation (RPA). Envision a financial landscape where software robots, equipped with algorithms designed for pattern recognition and data categorization, navigate the complexities of financial operations. These digital assistants autonomously execute rule-based tasks such as data extraction and reconciliation with human-like precision.

RPA's integration capabilities with existing APIs and stringent security measures facilitate the transformation of financial processes without disrupting established systems. Its scalability, ability to execute multiple tasks in parallel and commitment to continuous improvement establish RPA as a pivotal solution for reshaping the future of finance operations.

Against this backdrop of technological evolution, a particularly illustrative example emerges from the oil and gas industry. Here, RPA is redefining invoice processing. Join us as we delve into the transformative impact of RPA on invoice processing in this sector, uncovering both the challenges and the unprecedented opportunities. This article will guide you through the complexities faced in invoice processing in the oil & gas industry and illustrate how RPA's automation blueprint is revolutionizing conventional methods.

Evolving Dynamics of Invoice Processing in the Oil and Gas Sector

In the Oil and Gas industry, known for its vast supply chains and complex financial transactions, manual invoice processing presents significant inefficiencies. This exploration reveals the endemic errors and delays in traditional approaches within this dynamic sector.

Invoices in the Oil and Gas industry vary greatly, from unstructured to highly organized formats. They arrive through diverse channels, including emails with attachments in formats like PDF, Word, or Excel, and physical documents.

- Manual processing leads to human errors, reducing the accuracy and reliability of financial transactions. This often results in discrepancies, misentries, and reconciliation challenges, escalating operational costs and hindering timely decision-making.

- The variety of invoice types, along with different delivery methods, creates complexity for finance teams. Unstructured invoices require nuanced data extraction, while structured ones necessitate the recognition and interpretation of specific fields.

- The dual nature of invoice delivery, both digital and physical, poses a logistical challenge. Finance professionals must integrate these varied inputs into a unified system, demanding an automation solution that is adaptable and capable of handling both digital and physical document intricacies.

This complex landscape of invoice processing, with its mix of digital and physical elements, underscores the need for an adaptable, comprehensive automation solution like RPA.

The RPA Advantage: Precision in Streamlining Invoice Processing

Addressing these complex challenges requires an innovative solution capable of differentiating between unstructured and structured formats, processing various email attachments, and integrating physical documents into an automated workflow.

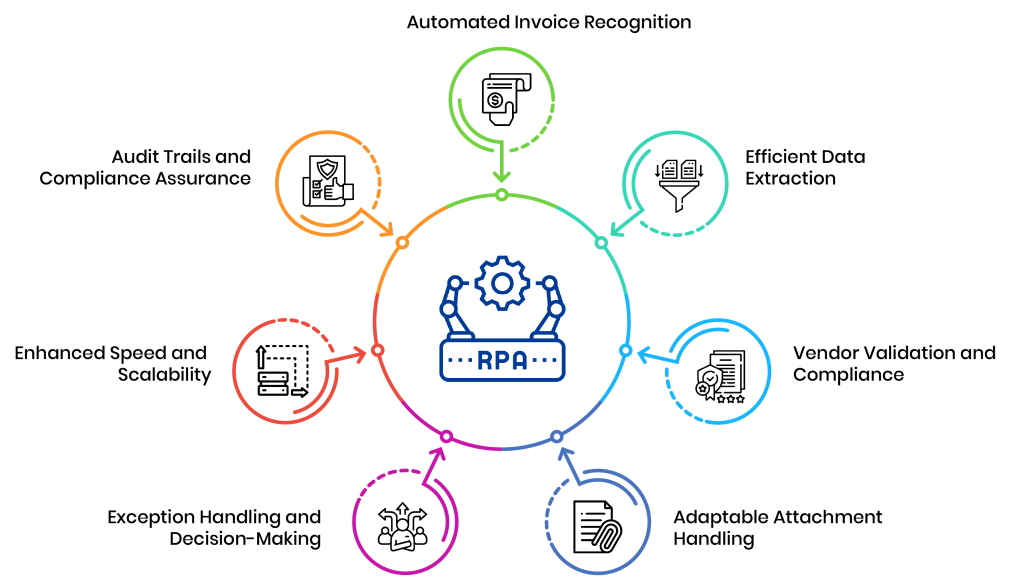

Integration of Robotic Process Automation (RPA) marks a transformative era in invoice processing. Let’s explore the key advantages that RPA offers:

Automated Invoice Recognition:

RPA utilizes advanced Optical Character Recognition (OCR) and machine learning algorithms to accurately identify various invoice types. This capability allows RPA bots to intelligently and precisely categorize diverse invoice types, ensuring efficient handling of both unformatted and formatted documents.

Efficient Data Extraction:

A core strength of RPA is its ability to swiftly and accurately extract critical data fields from invoices. By automating this process, RPA bots efficiently capture details such as vendor information and invoice amounts, minimizing manual errors and expediting processing times through effective data cataloging.

Vendor Validation and Compliance:

RPA significantly enhances vendor validation processes. By cross-referencing extracted data with pre-defined vendor databases, it ensures accuracy and compliance, mitigating the risk of incorrect payments and bolstering financial integrity. This feature of RPA not only streamlines processes but also fortifies the financial integrity of operations.

Adaptable Attachment Handling:

RPA's versatility is evident in its ability to process various invoice attachments, from PDFs and Word documents to Excel sheets. This adaptability demonstrates RPA's technical resilience, offering a robust solution across different file formats.

Exception Handling and Decision-Making:

RPA enhances the intelligence of invoice processing by adeptly managing exceptions. When encountering irregularities, RPA bots can make informed decisions or efficiently escalate issues, ensuring dynamic adaptability and aligning with strategic decision-making processes.

Enhanced Speed and Scalability:

The automation of complex steps significantly accelerates invoice processing. This efficiency enables finance departments to manage higher volumes of invoices, crucial in industries like Oil and Gas with substantial transaction volumes, without additional resources, showcasing RPA's scalability.

Audit Trails and Compliance Assurance:

RPA transforms invoice processing with unparalleled transparency and accountability. Detailed audit trails ensure adherence to regulatory requirements and internal standards, reinforcing governance structures and building stakeholder confidence in the financial process's integrity.

The advantages of RPA in invoice processing embody precision, efficiency, adaptability, and enhanced control. By leveraging RPA, organizations, especially in the Oil and Gas sector, can master the intricate aspects of invoice management with technological finesse and effectiveness. This positions RPA as a transformative tool in finance, offering a harmonious blend of automation and accountability.

Implementing Automated Invoice Processing: Our Strategic Approach

Traditional invoice processing in the oil and gas industry, characterized by manual data entry and verification against purchase orders, is both time-consuming and prone to errors. By automating this workflow using OCR, AI, and ML, we significantly reduce manual efforts and minimize the risks of errors and fraud.

Our team of automation experts at Qentelli has developed a strategic approach, employing a comprehensive automation toolkit to streamline the invoicing workflow. At the heart of our automated invoice processing system is a three-way matching process that enhances accuracy and reduces manual labor. This process includes:

- Recording and Validating Data on Purchase Order: Leveraging automation to accurately record and validate purchase order data, ensuring consistency and reducing manual verification efforts.

- Interpreting Invoice Data According to Rules and Standards: Utilizing AI to interpret invoice data, aligning with established rules and standards, thereby enhancing accuracy and compliance.

- Generating Invoices for Approval and Posting Data into ERP System: Automatically generating invoices for approval and seamlessly integrating them into the ERP system, streamlining the approval process and ensuring data integrity.

This strategic approach not only optimizes invoice processing but also aligns with our overarching business objectives of financial efficiency, regulatory compliance, and enhanced decision-making.

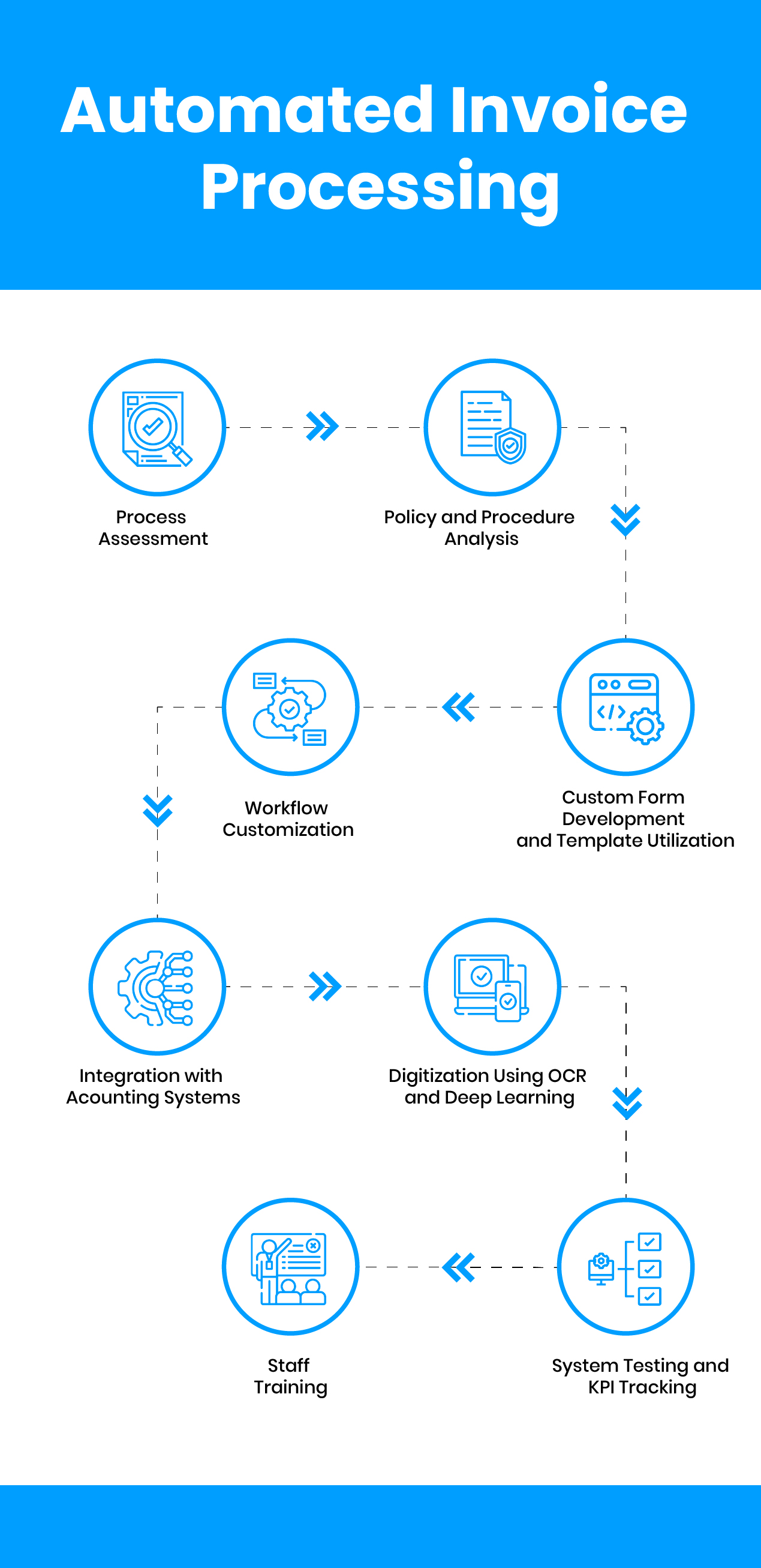

After selecting the right tech stack for the automation process, our strategic approach includes several key steps:

Process Assessment:

Conduct a thorough assessment of the current process to pinpoint bottlenecks and inefficiencies, identifying priority areas for automation.

Policy and Procedure Analysis:

Analyze organizational policies and procedures to define approval hierarchies, ensuring the automated process aligns with internal controls.

Custom Form Development and Template Utilization:

Develop custom forms or use pre-built templates with drag-and-drop features for ease of use.

Workflow Customization:

Customize workflows with conditional rules to efficiently route the invoice process.

Integration with Accounting Systems:

Seamlessly integrate the invoicing process with existing accounting systems to ensure smooth data exchange.

Digitization Using OCR and Deep Learning:

Employ OCR technology for data image verification and extraction, and deep learning for data validation and AI-assisted error handling to minimize the error rate.

System Testing and KPI Tracking:

Perform comprehensive testing to ensure system performance meets expectations, evaluating success by tracking KPIs such as processing time, error rate, and cost.

Staff Training:

Provide extensive training to staff for effective usage of the automated invoice process.

Automated invoice processing represents a paradigm shift in accounts payable, leveraging technology to streamline financial workflows. Our strategic approach to automation exemplifies this transformative power, offering organizations not just enhanced efficiency and accuracy, but also positioning them for sustainable growth in the dynamic business landscape.

Challenges and Solutions in RPA Adoption in the Oil and Gas Industry

A Gartner research report underscores the efficiency of RPA, highlighting a potential one-third reduction in operational costs. However, its adoption, particularly in the oil and gas industry, faces certain challenges:

Misconceptions:

- Challenge: There's a misconception in the oil and gas industry that RPA cannot integrate with legacy systems.

- Solution: Contrary to this belief, RPA can seamlessly integrate with existing systems without requiring architectural modifications.

Security Concerns:

- Challenge: There are apprehensions about potential data breaches during RPA implementation.

- Solution: RPA technology addresses these concerns with features like multi-tenancy and privileged access, ensuring data protection and integrity.

Lack of Expertise and Resources:

- Challenge: The oil and gas sector often faces a shortage of technicians with specialized RPA knowledge.

- Solution: Collaborating with experienced RPA vendors or establishing networks of associates and partners can facilitate the transfer of automation knowledge and streamline the implementation process.

Addressing these challenges is crucial for unlocking the full potential of RPA in the oil and gas industry. Dispelling misconceptions, prioritizing security, and fostering industry collaborations are key to successful implementation, leading to enhanced efficiency, security, and operational excellence.

End Note

As the Oil and Gas sector vigorously pursues digital transformation, the critical role of automated invoice processing becomes increasingly apparent. At Qentelli, we offer a solution that epitomizes the perfect synergy between human insight and technological innovation, propelling finance operations to new heights. Leading the charge in this technological revolution, we provide a holistic and comprehensive automation solution, transcending the capabilities of conventional RPA.

By seamlessly integrating Business Process Management (BPM) and Artificial Intelligence (AI) with RPA, we tailor our approach to meet the unique demands of the Oil and Gas industry. This fusion ensures a future-ready solution, enhancing operational efficiency and decision-making precision.

Embark on this journey towards digital excellence in finance operations with us. Partner with Qentelli to navigate this transformative path, as we elevate your financial workflows beyond traditional boundaries, harnessing the power of RPA, BPM, and AI.

Take the first step towards a more efficient and agile financial future. Contact us to discover how our RPA solutions can reshape your finance operations, propelling your business towards a groundbreaking era of innovation and efficiency.