Make your financial app stand out with our key considerations. Here are a few insights into what you need to know before you start developing a financial services app.

In the rapidly evolving world of finance, digital transformation has become a necessity for businesses to stay ahead of the game. The development of financial services applications has become crucial for companies to provide convenient, efficient, and secure services to their clients. However, building a financial services application is not as simple as it may seem. There are several key considerations that must be taken into account to make sure that the application meets the requirements of both the business and the end users.

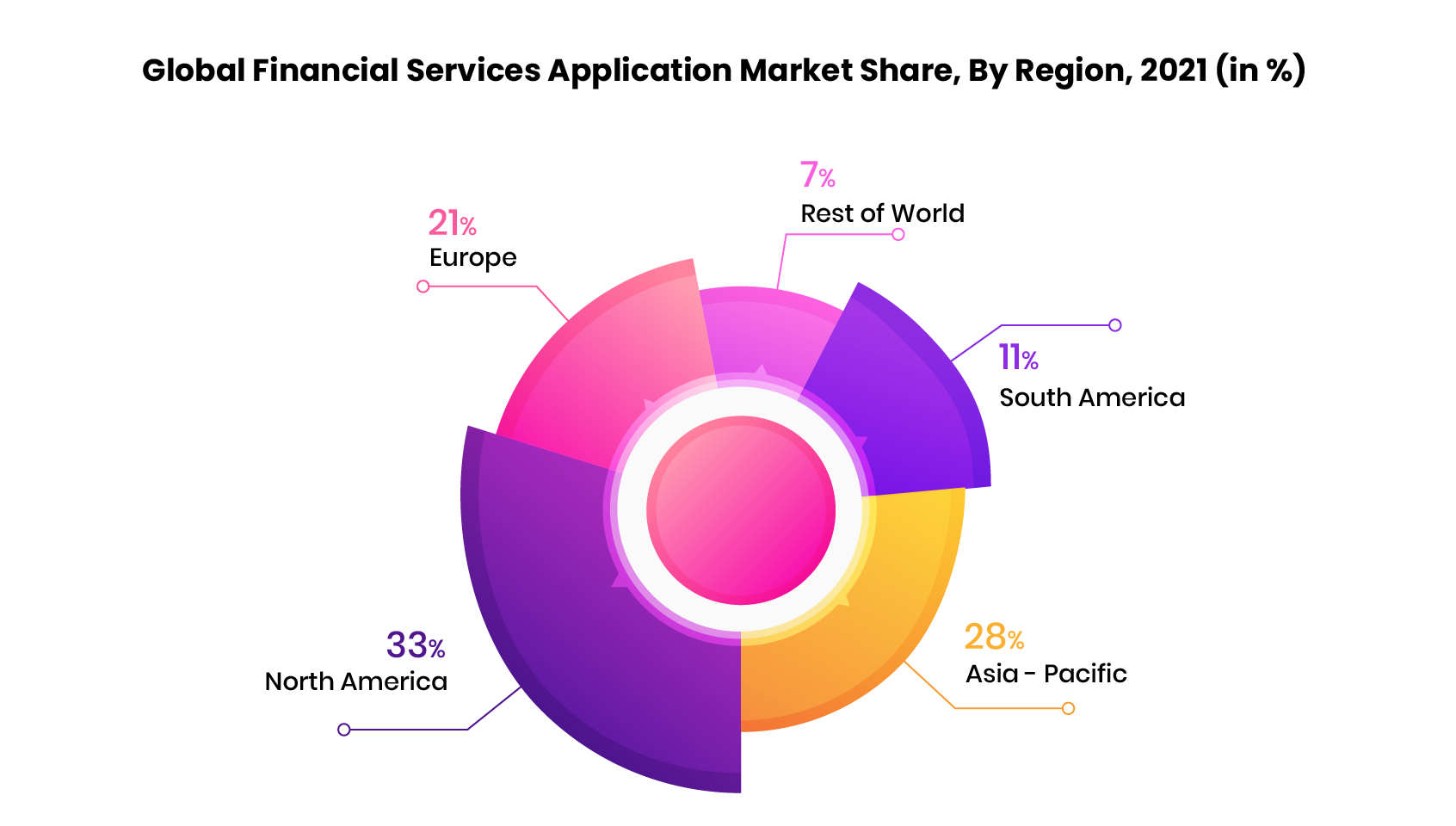

The financial services industry is projected to witness a significant surge in the application market size, with an estimated valuation of $167.5 billion by 2027, at a CAGR of 7.51% during the forecast period from 2022 to 2027. This growth is attributed to the increasing interest of financial institutions worldwide in ensuring client trust, privacy, and risk management.

The deployment of financial services applications has enabled end-users to augment their monitoring of real user experiences, portfolio management, business transaction processing, and insurance data exchange, among other features. These applications are instrumental in establishing customer trust and increasing market value. Financial institutions are becoming increasingly reliant on technology to provide customers with more comprehensive and personalized services, and financial services applications play a vital role in this regard. By leveraging these applications, financial service providers can streamline their operations, improve their risk management capabilities, and enhance their overall customer experience.

Compliance and regulation considerations

When building a financial services application, compliance and regulation considerations should be at the top of your mind. The financial industry is heavily regulated, and failure to comply with the latest industry regulations can lead to heavy fines, lawsuits, and reputational risk. Therefore, it is important to make sure that your application is compliant with all relevant regulations and industry standards.

One of the key regulations to consider is KYC (Know Your Customer). KYC regulations mandate financial institutions to authenticate the customer identity before providing them access to services. This is to prevent terrorist financing as well as money laundering, and other illegal activities. To comply with KYC regulations, your application must have robust processes in place for identity verification.

Another regulation to consider is PCI DSS (Payment Card Industry Data Security Standard). This standard outlines security requirements for businesses that handle credit card information. Compliance with PCI DSS is key for ensuring the security of customer information and preventing fraud.

In addition to KYC and PCI DSS, there are several other regulations and standards that financial services applications must comply with. These include GDPR (General Data Protection Regulation), AML (Anti-Money Laundering), and SOC 2 (Service Organization Control 2). It is important to work with legal and compliance experts to ensure that your application meets all relevant regulations and standards.

Security and authentication considerations

Security is a top priority for financial services applications. With sensitive customer data and financial transactions at stake, any security breach can result in significant financial and reputational damage. Therefore, it is very important to ensure that your application has robust security measures in place.

One of the most significant security measures to consider is encryption. Encryption is the process where data is converted securely into a code to prevent any unauthorized access. Your application should encrypt all sensitive data, including customer information and financial transactions, both in transit and at rest.

Another security measure that’s important is the two-factor authentication (2FA). 2FA adds an additional layer of security where users are required to clear two layers of identity before accessing their accounts. This can be in the form of a password and a fingerprint scan or a password and a one-time code sent via SMS.

Your application should also have robust access control measures in place. Access control ensures that only authorized users can access sensitive customer data and functionality. This can be achieved through features such as role-based access control, which limits access based on the role of a user within the organization.

User experience and design considerations

User experience and design are crucial for financial services applications. A poorly designed application can result in frustration for users and lead to them abandoning the application in favor of a competitor. Therefore, it is key to ensure that your application is user-friendly and has an intuitive design.

One of the most important things to be considered for user experience is simplicity. You should be able to easily navigate your application with clear instructions and minimal distractions. It should also be clearly optimized for use in mobile devices, as many users prefer to access financial services on their smartphones.

Personalization is assuming more importance in the financial services industry. Personalization involves tailoring the user experience according to the needs and preferences of an individual user. This can be achieved by the provision of features like personalized recommendations, customized alerts, and personalized onboarding.

In addition to simplicity and personalization, accessibility is also an important consideration. Your application should be accessible to users with special needs and visual or mobility issues. This can be done by incorporating innovative features such as screen readers, keyboard navigation, and high-contrast color schemes.

Integration with third-party services and APIs

Financial services applications often need to integrate with APIs as well as third-party services to provide additional functionality. However, integrating with third-party services can introduce security and compliance risks. Therefore, it is essential to ensure that all integrations are carefully vetted and meet the necessary security and compliance requirements.

One of the most important considerations for third-party integrations is data privacy. Third-party services may collect and process customer data that can lead to privacy concerns. It is essential to ensure that all third-party services are GDPR-compliant and have robust data privacy measures in place.

Another consideration is API security. APIs are a common target for cyber attacks, as they provide access to sensitive data and functionality. Therefore, it is essential to ensure that all APIs are secure and have robust authentication and authorization processes in place.

Integration with financial systems

A financial services application must be able to integrate seamlessly with the financial systems it interacts with, such as banks, investment firms, and payment gateways. This integration ensures that transactions are completed accurately and in a timely manner and that customers have access to real-time data about their financial accounts.

Scalability and performance considerations

Scalability and performance are essential for financial services applications. As the application grows and more users use it, it must have the capability to handle increased traffic and growing volume of transactions without crashing down. Therefore, it is essential to ensure that your application is scalable and has robust performance measures in place.

One of the most key considerations for scalability is cloud hosting. Cloud hosting allows your application to scale up or down as required so that it can handle increased traffic and transactions without downtime. It also provides better security and disaster recovery capabilities than on-premise hosting.

Another important consideration is load testing. Load testing involves simulating high levels of traffic and transactions in order to test the performance of the application under stress. Load testing can identify performance bottlenecks and help optimize the application for scalability.

Choosing the right technology stack

Choosing the right technology stack is essential for building a successful financial services application. The technology stack should be secure, easy to maintain and scalable. It should also have a robust developer community and support for third-party integrations.

One of the most important considerations for the technology stack is the programming language and frameworks. The choice of language should be based on factors such as scalability, security, and developer expertise.

Testing and quality assurance

Testing and quality assurance are essential for ensuring that your financial services application meets the necessary security, compliance, and performance standards. Testing should be conducted throughout the development process to identify any potential issues and also address them before they become major problems.

One of the most important strategies for testing is automated testing. Automated testing involves using tools and scripts to test the application's functionality, security, and performance. Automated testing can save time and ensure consistent testing across different environments.

Another consideration is penetration testing. Penetration testing involves simulating cyber attacks to identify vulnerabilities in the application's security. Penetration testing has to be carried out regularly to ensure that the application remains secure.

Maintenance and updates

Maintenance and updates are very important to ensure that your financial services application remains secure, compliant, and performant. Regular maintenance and updates can also improve the overall user experience and incorporate new features as well as functionality.

An important consideration for maintenance and updates is version control. Version control involves tracking changes to the application's code and ensuring that all changes are properly tested and documented. Version control can improve collaboration between developers and ensure that the application remains stable and secure.

Another consideration is patch management. Patch management involves applying updates and patches to the application's software and infrastructure to address security vulnerabilities and performance issues. Patch management should be conducted regularly to ensure that the application remains secure and performant.

Here is our take on Building a Financial Services Application

Building a financial services application is a complex process that takes into account several key factors. Compliance and regulation, security, user experience, integration with third-party services, scalability, and performance, choosing the right technology stack, testing and quality assurance, and maintenance and updates are all essential considerations.

As more people prefer to conduct their transactions online, the need for robust, user-friendly, and secure financial apps has never been greater. Developing a financial services app requires careful planning and execution, with many steps to consider. By keeping these considerations in mind, you can build a financial services application that is not only user-friendly but also compliant with regulations and industry standards.