In today’s rapidly changing business landscape, integrating advanced technologies is essential, particularly in finance and operations. SAP BPI emerges as a pivotal technology, endowing organizations with powerful tools to revolutionize traditional methodologies. These tools not only enhance control and efficiency but also redefine business operations.

This analysis delves into SAP BPI’s practical applications and advantages, demonstrating its potential to streamline operations, augment efficiency, and fortify compliance within financial and controlling domains.

Why SAP BPI?

SAP Business Process Intelligence (BPI) stands as a groundbreaking solution, transforming the business landscape. It integrates critical tools for business process analysis and enhancement into a comprehensive suite. This synergy of Business Process Management tools with enterprise software is a significant stride forward, filling historical gaps in process management.

Key tools like SAP Process Insights and Signavio act as catalysts for transformative change with their advanced process mining capabilities. SAP Signavio, in particular, elevates financial and control operations in several ways:

- Real-time Data Integration for Operational Resilience: SAP Signavio Process Intelligence enables real-time data integration, offering complete visibility into system processes. This feature supports immediate compliance checks, bolstering operational resilience and regulatory adherence.

- Visualizing and Analyzing Business Processes: SAP Signavio provides a comprehensive view of financial operations. This insight helps in pinpointing improvement areas, enhancing financial and control processes.

- Enhancing Business Optimization through Automation: SAP Signavio's suite, including modeling, mining, governance, and automation tools, drives business optimization. It harnesses process mining metrics for actionable insights and quick process enhancements.

- Key Performance Indicator Monitoring: SAP BPI excels in monitoring critical KPIs like cycle time, cost per transaction, and error rates. This detailed monitoring helps in understanding overall process efficiency and identifying areas ripe for automation.

Ultimately, SAP Signavio empowers CFOs and CDOs to make strategic, data-informed decisions, improving financial processes and contributing to overall operational excellence.

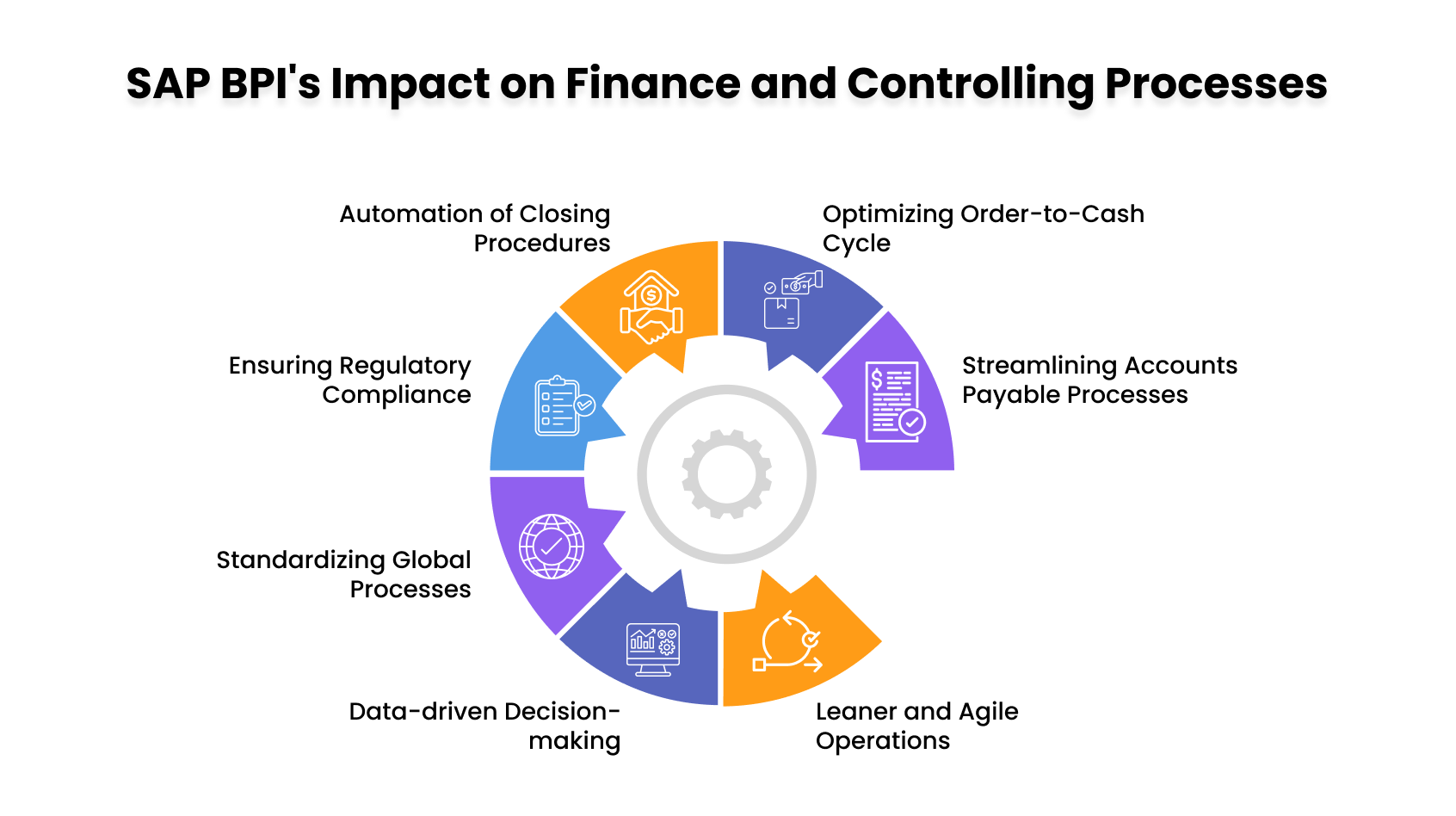

Tangible Gains: SAP BPI's Impact on Finance and Controlling Processes

SAP Business Process Intelligence (BPI) actualizes significant, tangible benefits, notably transforming finance and controlling processes. The key impacts include:

- Streamlining Accounts Payable Processes: SAP BPI automates invoice processing and enhances payment accuracy, substantially reducing manual workload. This boosts efficiency and precision in financial transactions.

- Optimizing Order-to-Cash Cycle: It focuses on shortening cycle times, improving cash flow, and boosting customer satisfaction in the order-to-cash process. These improvements lead to more streamlined, customer-focused financial operations.

- Automation of Closing Procedures: SAP BPI is instrumental in automating closing procedures, thereby reducing time and enhancing accuracy in financial closures. This not only speeds up the process but also ensures precision in financial reporting.

- Ensuring Regulatory Compliance: The implementation of automated controls and robust audit trails by SAP BPI is essential for maintaining compliance with financial regulations. This ensures transparency, accountability, and adherence to regulatory standards.

- Standardizing Global Processes: SAP BPI aids in standardizing processes across various locations, minimizing operational risks, and ensuring consistency in financial practices worldwide.

- Data-driven Decision-making: SAP BPI’s operational process intelligence software enables organizations to leverage data-based process discovery for assessing process execution. This empowers finance professionals to make informed decisions based on real-time insights.

Leaner and Agile Operations: SAP BPI's comprehensive understanding of business processes fosters leaner, more agile enterprises. This agility directly influences finance and controlling processes, ensuring adaptability to changing business needs.

In summary, SAP BPI extends beyond theoretical benefits, offering tangible gains by optimizing processes, minimizing manual efforts, ensuring compliance, and enhancing efficiency in finance and controlling operations.

A recent report by McKinsey underscores that companies utilizing SAP BPI witness an average of 20-30% improvement in process efficiency within the first year of implementation.

How is SAP BPI shaping the future of finance and controlling operations?

Gartner's study identifies SAP BPI as a transformative force in finance and controlling operations, driving significant efficiency improvements. An in-depth exploration of SAP BPI’s prospects in these key business areas reveals:

- Intelligent Transformation: SAP BPI is at the forefront of intelligent transformation, employing data analytics for strategic decision-making in finance and controlling operations. This approach aligns with the need for data-driven strategies in modern finance.

- Agile Financial Management: The synergy between SAP BPI and SAP FICO facilitates a seamless, responsive financial management system, embodying agility in financial operations.

- Business Growth: SAP partners recognize BPI as a catalyst for growth, uncovering new potentials and establishing it as a key driver for future business expansion.

- Maximizing Operations in SAP S/4HANA: Within the SAP S/4HANA ecosystem, SAP BPI is crucial for optimizing operations, highlighting its role in the evolution of business processes.

- Modernization of Financial Processes: SAP Signavio, a key component of SAP BPI, modernizes financial processes, ensuring they are adaptable to future industry standards and challenges.

- Customer Excellence through Process Mining: By leveraging process mining to analyze customer experience and operational data, BPI optimizes processes for enhanced customer satisfaction, underscoring its role in customer-centric business models.

In summary, SAP BPI is not just redefining current financial and controlling operations; it is setting the stage for future innovations and strategic business evolution. This positions SAP BPI as a vital tool in the arsenal of forward-thinking businesses, particularly in adapting to and shaping future market dynamics.

Wrapping up:

In conclusion, SAP Business Process Intelligence (BPI) stands as a revolutionary force, redefining finance and controlling operations. With its advanced tools and seamless integration with systems like SAP FICO, BPI is more than a process enhancer; it's a driver of intelligent transformation and business growth. The real-time data integration and process visualization offered by SAP Signavio fortify operational resilience and inform strategic decision-making. In practical terms, BPI streamlines accounts payable, optimizes order-to-cash cycles, simplifies closing procedures, ensures regulatory compliance, and standardizes global processes.

But SAP BPI's role extends beyond delivering immediate benefits; it's a key architect in the future landscape of finance and controlling operations. As we stand at the brink of this era of innovation and evolution, we invite businesses ready to embrace this transformation. Our expertise dovetails with the capabilities of SAP BPI, offering a partnership that transcends traditional consulting boundaries. Engage with us to revolutionize your financial and controlling operations, paving the way for a future-ready, efficient, and resilient business model. Together, let's shape a future where operational excellence is not just a goal but a sustainable reality.