Governance, Risk, and Compliance (GRC) plays an indispensable role in the contemporary business landscape. It involves the implementation of policies, procedures, and controls to ensure that an organization operates in a compliant manner. GRC Tool offers a unified approach to managing risks, ensuring compliance, and maintaining good governance.

However, investing in a GRC platform can be a significant financial commitment for any organization, and calculating ROI on such investment could be tricky given the complexity of implementation, opportunity costs, and intangible benefits. This article will provide an overview of evaluating and maximizing ROI on GRC platform investments, tangible & intangible benefits, and the framework to choose the most suited GRC platform for your business.

The Benefits of Implementing GRC Platforms:

Let’s start with understanding why assessing effectiveness of GRC platform could be tricky. The complexity in assessing the ROI of GRC platform lies in the fact that many of these benefits are intangible and effect of some of the tangible ones need gestation period before these benefits are visible.

Tangible Benefits:

1. Cost Reduction:

GRC platforms streamline processes, reducing the need for manual and redundant efforts. This leads to cost savings in terms of reduced labor hours, lower audit and compliance costs, and decreased operational expenses.

2. Improved Compliance:

GRC platforms enhance compliance with regulatory requirements. This can result in fewer fines, penalties, and legal costs associated with non-compliance. Additionally, improved compliance can lead to better relationships with regulatory authorities.

3. Risk Mitigation:

Effective risk management through GRC platforms helps identify and mitigate potential risks. This can lead to fewer incidents, losses, and insurance claims, directly impacting the bottom line.

4. Efficiency and Productivity:

Automation and streamlined processes increase operational efficiency and productivity. Employees can focus on value-added tasks rather than administrative work.

5. Enhanced Decision-Making:

GRC platforms provide real-time data and insights, enabling informed decision-making. This can lead to better strategic choices and revenue optimization.

6. Quantifiable Metrics:

Tangible benefits are quantifiable and measurable, making it easier to calculate the return on investment in monetary terms.

Intangible Benefits:

1. Enhanced Reputation:

Effective GRC practices can enhance an organization's reputation and trustworthiness among customers, investors, and stakeholders. This reputation can lead to increased brand value and customer loyalty.

2. Improved Strategic Alignment:

GRC platforms help align risk and compliance management with strategic objectives. While not directly measurable in monetary terms, this alignment contributes to long-term organizational success.

3. Stakeholder Confidence:

Stakeholders, including investors and board members, gain confidence in the organization's ability to manage risks and comply with regulations. This can result in increased investments and support.

4. Adaptability to Change:

GRC platforms enhance an organization's ability to adapt to changing regulatory environments and market dynamics. This adaptability can be critical for long-term sustainability.

5. Employee Satisfaction:

Streamlined processes and reduced compliance burdens can improve employee satisfaction and retention, although this is challenging to quantify in monetary terms.

6. Strategic Risk Management:

Effective GRC allows organizations to proactively identify and address emerging risks, safeguarding their long-term viability.

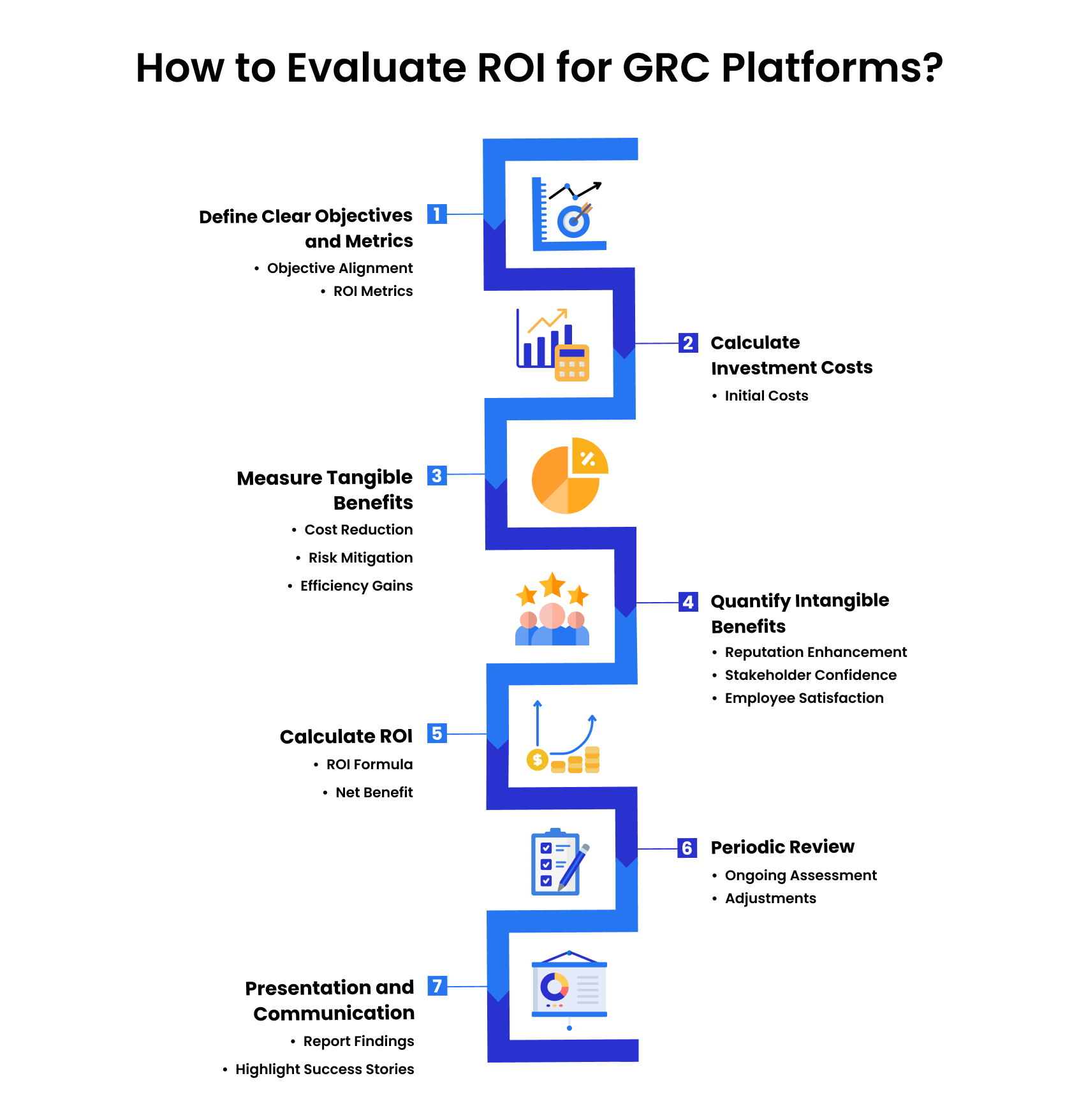

How to Evaluate ROI for GRC Platforms?

Evaluating the ROI for Governance, Risk, and Compliance (GRC) platforms is a crucial step in justifying the investment for your stakeholders. Here's a comprehensive approach to evaluating ROI for GRC platforms:

1. Define Clear Objectives and Metrics

- Objective Alignment: Ensure that the objectives of the GRC platform implementation align with the strategic goals of the organization.

- ROI Metrics: Define specific, measurable, and time-bound metrics that will be used to evaluate the ROI. These metrics may include cost savings, risk reduction, compliance improvements, and efficiency gains.

2. Calculate Investment Costs

- Initial Costs: Calculate the upfront costs associated with acquiring and implementing the GRC platform. This includes software licensing, hardware, consulting fees, and employee training.

- Maintenance Cost: Including annual subscription costs, scaling up costs and infrastructure costs.

3. Measure Tangible Benefits

- Cost Reduction: Identify areas where the GRC platform has led to cost reductions. This could involve reduced labor costs, lower audit expenses, and decreased fines due to improved compliance.

- Risk Mitigation: Assess how the GRC platform has contributed to risk reduction. Calculate the financial impact of avoided incidents or losses.

- Efficiency Gains: Measure the increase in operational efficiency and productivity resulting from streamlined processes and automation.

4. Quantify Intangible Benefits

- Reputation Enhancement: Estimate the impact of improved reputation and trustworthiness on customer loyalty and brand value.

- Stakeholder Confidence: Assess the potential increase in investments and support from stakeholders due to improved GRC practices.

- Employee Satisfaction: Though challenging to quantify, consider the impact of improved employee satisfaction on retention and productivity.

5. Assessing ROI

- Net Benefit: Calculate the total benefits (tangible and intangible) minus the investment costs.

- Visualization: Create visual representations, such as charts or graphs, to present the ROI calculation effectively.

6. Periodic Review

- Ongoing Assessment: Continuously monitor the GRC platform's performance and its impact on ROI. Update metrics and ROI calculations as needed.

- Adjustments: Make adjustments to the GRC strategy and implementation based on feedback and changing business conditions to maximize ROI over time.

7. Presentation and Communication

Convincing your stakeholders about the impact is as important as the successful adaption to GRC platform. Here are a couple of things that you should take into account:

- Report Findings: Present the ROI findings to key stakeholders in a clear and compelling manner. Use visual aids and storytelling to convey the value of the GRC platform.

- Highlight Success Stories: Share success stories and specific examples of how the GRC platform has contributed to achieving organizational goals and objectives.

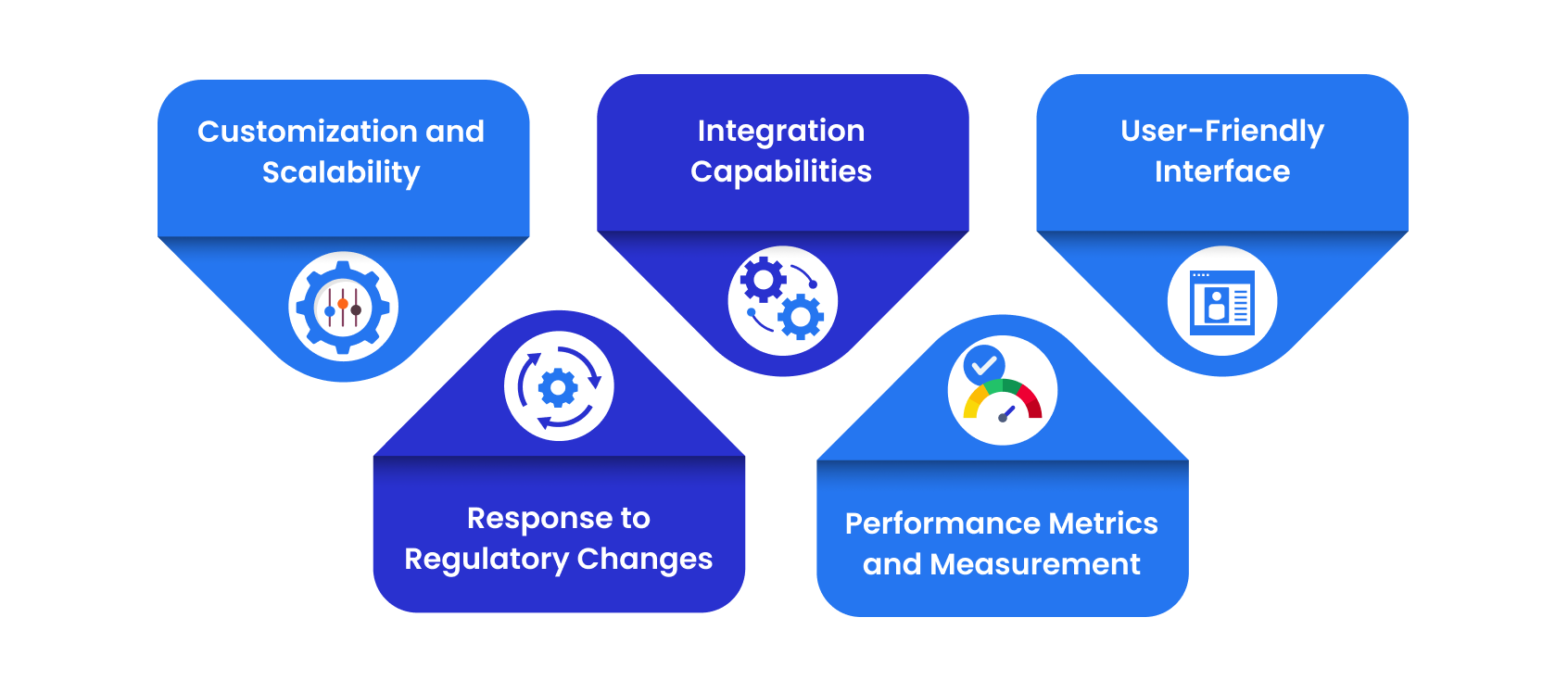

Choosing the Ideal GRC Platform for Your Business

There are many GRC platforms available in the market. Selecting one among these options could be a daunting task. We would suggest you to use the following filters to select most suitable GRC platform for your business:

1. Customization and Scalability

An effective GRC platform offers customization options that allow businesses to tailor the solution to their unique requirements.

Furthermore, scalability is essential to accommodate growth without disrupting existing processes. The ability to adapt the platform to changing needs prevents the necessity for frequent system replacements and preserves the initial investment.

2. Integration Capabilities

Modern businesses rely on a multitude of systems and applications to operate efficiently. For a GRC platform to be truly effective, it must seamlessly integrate with these existing tools.

Integration prevents data silos and ensures a continuous flow of information. This integration enhances the accuracy of risk assessments, reduces duplication of effort, and ultimately improves the ROI of the platform.

3. User-Friendly Interface

A GRC platform with an intuitive and user-friendly interface encourages widespread usage across the organization.

Employees should be able to navigate the platform's features without extensive training, allowing them to leverage its capabilities effectively. A user-friendly interface reduces the learning curve and accelerates the platform's contribution to ROI.

4. Response to Regulatory Changes

Implementing a GRC platform is a continuous journey. In the changing regulatory landscape, responding to these updates is essential.

5. Performance Metrics and Measurement

To quantify the impact of a GRC platform, organizations must establish measurable performance metrics. These metrics can include a reduction in compliance deviations, time saved on manual tasks, or the frequency of risk incidents.

Regularly tracking and analyzing these indicators provides tangible evidence of the platform's contribution to the organization's bottom line. It also facilitates continuous improvement efforts that enhance ROI further.

Conclusion

Investing in a GRC platform can be a significant financial commitment for any organization. Therefore, evaluating a GRC platform's ROI and maximizing its benefits is essential.

Evaluating ROI requires considering several factors such as financial returns, non-financial benefits, and initial investment costs. Maximizing your investment requires customizing your platform, defining what success looks like, and measuring success against KPIs.