The famous saying ‘Data Is The New Oil,’ has been whittled down in effect and stands moderately accurate in the current sphere. A microscopic view of its distinct properties will show it's more of an asset than oil.

While the analogy stands true when seen in the context that both data and oil are useless unless processed or refined, it overlooks the fact that, unlike oil, data is not scarce. With technological advancement, data has only become more sustainable, reliable, and reusable. Moreover, with usage, data only grows useful, and yields more value.

Data is an asset, an asset that grows in value with use.

Today, data is an organization's core asset and plays a crucial role in improving operations, increasing revenue, and solidifying relationships with stakeholders. Like any other tangible asset, data also requires to be valued and managed. It helps in assessing which data asset needs to be taken care of, and which can be discarded. It further helps in maintaining a data portfolio, that will show you which data assets are giving a higher ROI. These calculations are crucial, given the value attached to the process of data valuation. Companies should be prudent in how they allocate their resources and make investments accordingly.

Attaching value and assessing data helps the organization inside out. Internally, it helps you make the right investment decisions, increase the value you provide to shareholders, and generate a competitive advantage. Externally, it helps third parties recognize the value of your data, identify clear financial metrics, and facilitate business decisions.

It's important to seek a price for

your data.

However, aggregating, managing, and creating value from a giant heap of data is not easy. Determining the value of a data asset, and assessing its quality and quantity is a complex process. It requires dedicated teams and a comprehensive data strategy to properly extract, store, and analyze the data. This article discusses a few valuation methods that will help you identify the worth of the data.

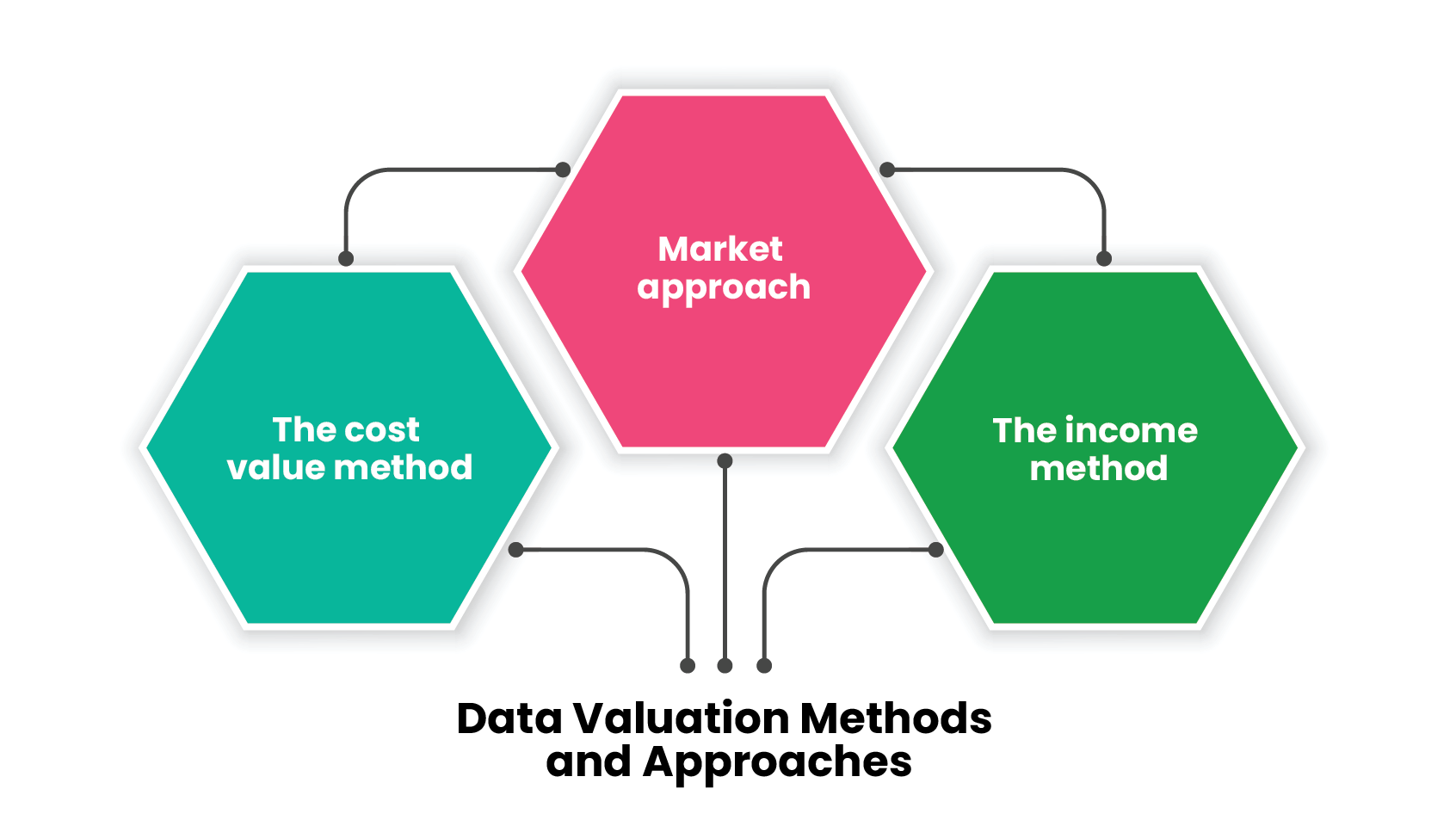

Three main types of valuation methods are commonly used for establishing the economic value of data:

The cost value method: Every piece of data has a direct cost associated, which includes the cost of collecting or acquiring, processing, storing, and even sharing the data. The cost value method computes the cost of generating the equivalent value of the data (in question) and computes its value. The derived figure serves as the basis for determining the price that can be charged by the buyer.

In short, the method considers the cost of replacing the data or the impact it will have on the cash flow if it gets lost or damaged.

It assesses the time and effort invested in producing, storing, analyzing, and transporting data.

Value is determined by the cost of producing the information/data.

Market approach: The market approach is one of the most popular data valuation methods. To determine the selling price, it considers the market prices of comparable data and checks what price data users are willing to pay for it. The method only considers willingness to pay and not the value created once the data have been put to use.

The method is useful only when the data in question is marketable or enough comparable thresholds are available. Sometimes companies keep their data private for security reasons or to sustain a competitive edge, making it difficult to find comparable data.

Value is determined based on the market price of comparable products in the market.

The income method: In this methodology, the value is determined by estimating the present value of its expected returns and revenues. It estimates the incremental value that it can render in the future over its remaining economic life. The approach makes income generated by the data as the most important measure of its worth. The approach considers - the income generated by the investment, the risks associated with the investment, the timing of the anticipated income, and the growth of the expected income. Several methods are widely used in applying the income approach, such as Discounted Cash Flow Method (DCF), Multi-Period Excess Earnings Method, Relief-From-Royalty Method, and Incremental Cash Flow Method (with and without).

It's a classic approach to valuation and makes income generated by the data as the key measure of its worth. However, often it's hard to measure and it’s susceptible to errors, given its high reliance on subjective approaches and assumptions. Its success hugely depends on how thorough and extensive the analysis was.

Value is determined by estimating the future cash flows that can be derived from the data

Final Thoughts

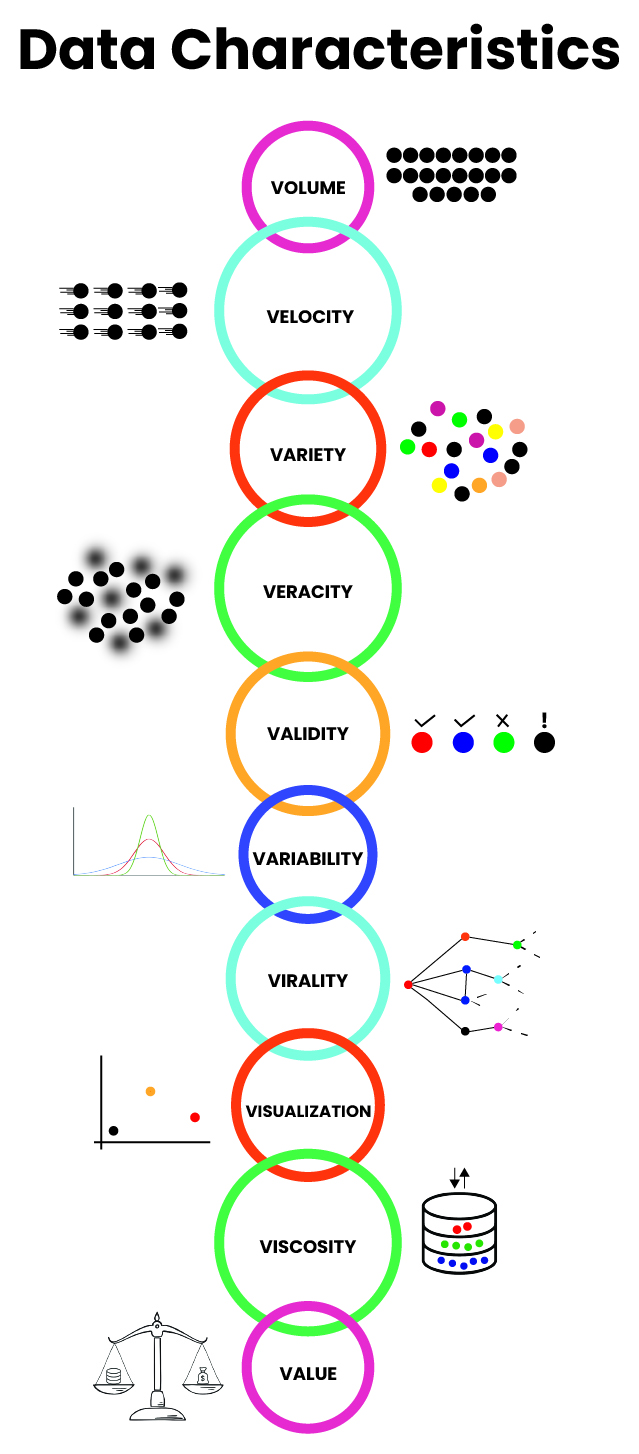

Data drive digital transformation and positively, as well as, negatively impact people, firms, and policymakers. It underpins value creation in business and companies should pay heed in selecting the right data valuation methods. There are a lot of practical, as well as conceptual challenges to it and to achieve the desired outcome it's important to have a clear understanding of the nature of your data and its various dimensions, including, the age of data, the purpose of valuation, and unique traits of your business.

Data is the lifeblood of an organization. While data valuation may be valuable to third parties, it's of more value to the firms themselves as they seek to optimize their operation. Data should be read as a tangible commodity and valued to see where it can be deployed to get the most return. This helps businesses make informed decisions and analyze which data is yielding profits and which is not.

More than an intangible asset, data value should be treated as a property. Its value should be assessed so people recognize its worth and give it the respect it deserves, and, within the organization, employees work out on how to make it more valuable. It further helps them validate the time and effort they invest in each data set.

Get In Touch

If you are interested in learning more about data valuations, Qentelli can help. For more information, please drop an email at info@qentelli.com. We look forward to connecting with you.